Powerful and liquid financial markets attract a large number of scammers

The Forex industry is one of the largest and most liquid markets, which means that huge amounts of money are moved back and forth every day, attracting many investors, speculators and of course fraudsters. Especially many beginners are enthusiastic about the possibilities to win a lot of money in a short time and quickly fall for the promises of many fraudsters.

There are many different kinds of fraud attempts in the Forex market.

For example

- the broker can intervene manipulatively and create high spreads or slippage in his advantage

- vendors sell Expert Advisors that do not deliver what was promised

- Trading results of Expert Advisors are manipulated

- And much more

You should also keep in mind that according to European Securities and Markets Authority (ESMA)

Between 74-89% of retail investor accounts lose money when trading CFDs.

In other words, with a probability of about 90% you will lose money. Therefore, do not be blinded by fraudsters and their empty promises. If you follow the advice below, you will significantly increase your chances of success and making money in the Forex market in the long run. Always keep your nerves and use your common sense. Nobody has money to give away. If something seems dubious to you, keep your distance. Successful acting always means hard work and only long term results are of interest. As in any industry, so in the Forex market, the fact is that the higher the potential profit, the higher the risk of losing the investment.

Before you decide to buy an Expert Advisor, consider the following critical issues. But also take a look at what we think a professional and trustworthy Expert Advisor must have.

Consider the Following Issues Before Buying an Expert Advisor

- If Expert Advisor is successful, i.e. is a real "cash machine", why would anyone want to sell it? The more investors pursue a single strategy, the higher the probability that this strategy will not work in the future. Therefore it is in the interest of every successful developer of strategies and Expert Advisors to keep it secret and only he has access to it. Also ask yourself why someone should sell it for little money.

- Always make sure that the seller can prove his strategy with a real signal. The signal should be at least one year old and profitable.

- If the seller does not have a real live signal, ask yourself why. If the Expert Advisor is successful, the seller should have no problem showing real results. Or maybe he has something to hide? Some sellers claim that they do not have a signal yet. Whether this is true or not cannot be verified, but this does not change the fact that the seller cannot prove profitability.

- Be careful if the seller only has a demo signal. With a demo signal the Expert Advisor might work, with a real signal it might not. With a demo signal, many factors that occur or may occur in practice are largely eliminated. For example: Costs of the broker (commission, spread) and slippage (due to the time delay in signal transmission and signal processing)

- Stay away from Expert Advisors, whose strategy is based on Martingale, Grid, Hedging and other risky money management techniques. Purely mathematically, these strategies will crash sooner or later, it is only a matter of time.

-

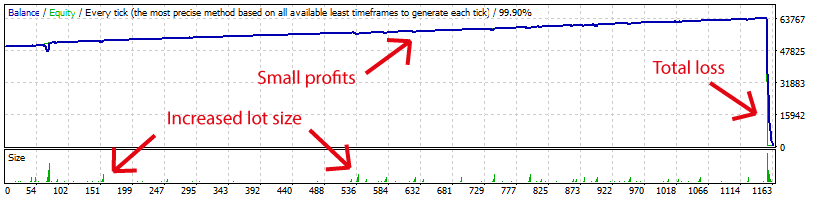

- Especially Martingale can be very treacherous. Here, after a loss, the lot size of the following trade or trades is increased, while the stake is reduced again after a win. This is why martingales can be easily recognized by the lot sizes of historical trades, which have isolated peaks (see the chart below with a typical result of the balance).

-

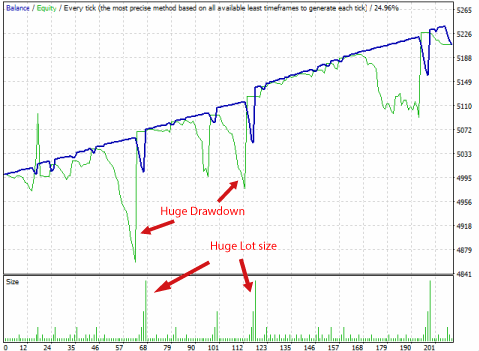

- Grid based strategies are trading against the market, opening new trades after predefined intervals (often with a larger lot size, like martingales) and hoping that the market will turn again sometime. This can go well for a long time, but at some point the market does not turn soon enough and you suffer a total loss. Typical for this strategy is regularly a big drawdown and like at Martingale many open trades against the market.

- Be careful with sellers who use psychological tricks to sell their Expert Advisor, such as artificial scarcity (through price advantage, quantity, added value). These sellers have only one thing in mind: to sell their software.

- Be careful if you buy software on websites that are specially designed for this Expert Advisor. Ask yourself, why doesn't he sell his Expert Advisor on the official MQL5 Market? On MQL5.com you have the opportunity to read comments and reviews from other buyers, but on a seller's own website this is not possible. The seller can customize everything in his own sense, there is no control authority. Most of the time you cannot even get a trial version for backtesting purposes.

- Often sellers present real signals e.g. on myfxbook.com. The results are often very good, but be careful, to get a signal with good results that runs successfully for months or even years is not difficult. To achieve this you just have to create a lot of trading acounts with different settings. Even if almost all of these accounts crash, only one account has to survive. This successful account will be the only one published, and will be displayed as if the Expert Advisor was successful. With this method, fraudsters lose very little money on their accounts, but charge a lot of money for their software.

- Often it can even be observed that the account of a successful signal has not been trading for several months or even years. Here, as long as the trade was successful, it was simply stopped before it crashed.

- Be careful with sellers who present signals with very good trading results, but which are only a few months old. A few months say almost nothing about long-term success.

- Also be careful if the Expert Advisor is significantly older than the presented signal, because what else should it mean but that the seller always starts a new signal because they all crash after a certain time?

- If the vendor shows backtest results, the first thing to check is what tick data quality the vendor used to create the backtests. If the quality of the modeling is not 99%, then in most cases the results are not usable. But even if the modeling quality is 99%, the backtest can still be unrealistic due to various incorrectly configured parameters. Learn here how we create realistic and high quality backtests of Expert Advisors.

- Often vendors present very good backtest results, even with a modeling quality of 99%. People tend to project these results into the future. Because if the Expert Advisor shows these results over years, it must show similar results in the future, right? Unfortunately, this is very rarely true. Most backtest results show a so-called overfitting. This means that the developer has adjusted the parameters of the Expert Advisor during the backtest for a certain time range until the results showed very good results. If you now test this Expert Advisor with the same parameters in another time range, you will notice that the results are rather poor.

- On the MQL5 Market for Expert Advisors (and also for indicators) we increasingly see that the most popular Expert Advisors were often released only a few months or even weeks ago. In addition, sellers show very good backtest results, a live signal is usually not given. Almost nothing can be said about a recently released strategy whose parameters have been worked out by backtesting. This is because the probability of overfitting is particularly high. If such Expert Advisors were really as good as the backtests indicate, shouldn't they remain permanently popular? Especially beginners fall for it, they buy the Expert Advisor and wonder why their new popular Expert Advisor is unprofitable. Unfortunately, because of possible overfitting, even the best backtest is of no use here. The recommendation here is to stay calm and not to be blindsided by the often very good psychological marketing strategies.

- Be wary of sellers who sell a relatively large number of Expert Advisors. How is a developer (usually equivalent to a seller) supposed to focus on and develop so many Expert Advisors? If the seller has one or even two successful Expert Advisors, he would focus on them and not develop another one, right? So if a seller sells a lot of Expert Advisors, the assumption is that he develops them just for selling, whether they are profitable is of secondary importance.

Is anything missing?

Write to us if you know of any further issues.

There will be moderation of all comments. Please also read our comment rules:

For open discussion, we reserve the right to delete any comment that is not directly on topic or has the sole purpose of disparaging readers or authors. We want people to communicate respectfully with each other, as if the discussion were with real people present. By submitting this form you agree to our Privacy Policy and the storage of your personal data.