Backtesting is a method of seeing how well a strategy or model would have performed in the past. Backtesting assesses the viability of a trading strategy by finding out how it would perform using historical data. If a strategy works in backtesting, it can be concluded that it will do so in the future. Nevertheless, one must always be aware that future results may not match historical results. For example, realistic backtesting is absolutely critical to whether the results are trustworthy. Furthermore, a so-called overfitting may have taken place. In this case, one has turned the parameters of the strategy until these parameters have been adjusted absolutely perfectly to the historical data and discovers that the strategy no longer works with the future data.

FAQ

The Calmar ratio is a measure of the performance of investment funds such as hedge funds. It is a function of the fund's average annual total return compared to its maximum drawdown. The higher the Calmar Ratio, the better the risk-adjusted performance over a given period (often 36 months).

It is human nature to prefer steadiness, continuity and predictability. We want certainty because it makes it easier to plan. We love to know what is coming.

This is also true for investing. We would prefer to always know how much return we will get for our money and that this amount will always remain the same.

This is exactly the weakness that many trading strategies, such as Martingale, exploit. It promises us regular, steady and even predictable profits. In other words, exactly what we all want. When investing, we are so obsessed with this predictability that we tend to forget that a real large loss is possible at any time. This will sooner or later wipe out all the gains and possibly even the initial deposit.

Especially for a trader it is important to be aware of this innate weakness and to slow oneself down. Therefore, stay away from dangerous strategies based on Martingale, Grid, Hedging and various hybrids.

Expert Advisors, also known as EA, are automated trading systems written in MQL4 or MQL5 programming languages. They are designed to automate trading activities in the MetaTrader trading platform so that they perform all trading activities automatically. Orders are then sent directly to the server, stop loss, take profit and trailing stop values are managed and adjusted. Expert Advisors follow various rules or algorithms to find the right time to enter and exit the market.

We have often asked ourselves, what is risk and how can it be minimized? Here are a few thoughts and incentives on this.

A famous quote from Robert Kiyosaki (successful real estate investor):

"What I know makes me money. What I don't know loses me money."

Here it becomes clear, it is not so much the investment that is risky, but rather the investor who acts risky.

Warren Buffett says the following about risk:

"Risk comes from not knowing what you're doing."

Conversely, the best way to minimize risk is to invest in yourself. Only with education, knowledge and mathematics does risky action turn into a correctly assessed investment. And this is what matters, in order to be successful in the long run, a realistic risk assessment must always take place. Warren Buffet himself spends a lot of time learning and claims that he spends 80% of his day reading.

"I just sit in my office and read all day." – Warren Buffett

Martingale belongs to a very risky and dangerous strategy where you can suffer a total loss. This strategy will even mathematically sooner or later lead to total loss. Therefore, the use of this strategy is not recommended.

Martingale is a gambling strategy that involves increasing the stake in case of a loss. Typically, the bet is even doubled in case of loss. So you bet on the occurrence of a certain event. If this does not occur, you double the bet and bet again on the occurrence of this event. This is continued until the desired event occurs.

The more trades are made with this strategy, the more likely it is to catch a long losing streak. The statistical profile of this strategy corresponds to the Taleb distribution. This means that the strategy has a payoff profile with a small positive return, but a small and very significant risk of total loss. One has here a high probability of a small profit, but a low probability of a significant loss. The expected value of this strategy is thus even rather less than zero. The risk increases exponentially with this strategy, while the payoff profile of the profit behaves only linearly.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are electronic trading platforms widely used by online forex traders. It was developed by MetaQuotes Software is licensed to forex brokers who provide the software to their clients.

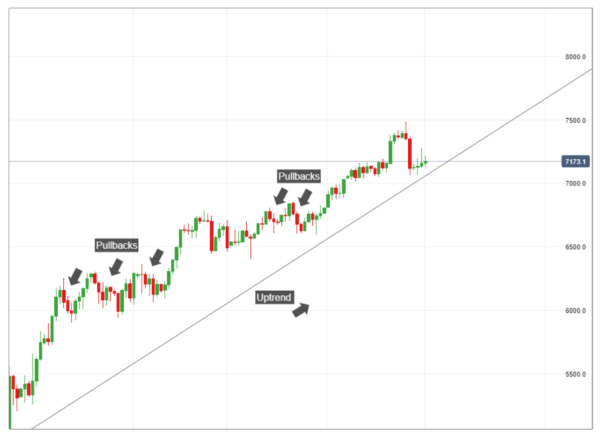

A pullback is a temporary interruption or dip in the overall trend of an asset. The term is also sometimes used interchangeably with "retracement" or "consolidation".

Like the Sharpe ratio, the return drawdown ratio is a key figure that measures the risk-return ratio of an investment. It is calculated by dividing the return achieved by the investment by its maximum drawdown over a given period. The higher the return drawdown ratio, the better the risk-return ratio.

Return drawdown ratio = r/ DD

where

r = investment return

DD = maximum drawdown

Scalping is a trading method based on real-time technical analysis. The main goal of a scalping strategy is to make small profits over a very short period of time. Often trades are open for only a few seconds to minutes. Here, for example, one takes advantage of strong and rapid changes in the market or one uses night scalping. The disadvantage is that due to the often very small profits, you have to increase the lot size. This brings the risk that losses can be very large. Especially when the market moves very fast, open trades can not be closed quickly enough, which can cause large losses. With night scalping, the often significantly larger spread must be taken into account.

Sharpe ratio describes the extent to which the return on an investment exceeded the risk-free interest rate and the volatility with which this return was achieved. The Sharpe ratio can be used in retrospect for a direct comparison between different financial investments in order to make a portfolio less risky. The idea behind the Sharpe ratio is to provide a way to measure the excess return of a fund per unit of risk. In this way, it is possible to assess whether the relationship between the return and risk of a fund is positive or negative.

Slippage refers to the situation when the price at which your order is executed does not match the price at which it was requested. Slippage occurs when the original price has changed during the period when your broker executes your order.

Slippage can occur at any time and basically has three causes. The first one is high volatility of the market. If there is a sudden price movement beyond, the trade might not be opened or closed in time and, for example, the stop might not be triggered at the originally set level. The second cause is a price gap in the market – this happens when the market moves seriously up or down and there is little or no trading during the rest periods. The third cause, which occurs especially in the case of market orders, is the time delay in the execution of the trade due to processing and transmission of information regarding the trade. For example, a large local distance between the trader and the broker server can cause a high ping.

The Sortino ratio is a measure of the risk-adjusted return on an investment. It is a modification of the Sharpe ratio. While the Sharpe ratio takes into account the volatility of the investment, the Sortino ratio only takes into account the part of the volatility generated by downward movements. The upward movements are considered favorable and are included in the calculation with a value of zero. As a result, the volatility component responds only to the frequency of downward movements.

By definition, a virtual private server (VPS) is a virtual machine (VM) that uses the resources of a physical server and provides users with various server functionalities comparable to those of a dedicated server. In most cases, a high-performance physical machine usually hosts several virtual private servers, each of which has its own operating system (for example, Microsoft Windows Server 2012 or newer) and grants users full access via the Internet.

For trading with Expert Advisors, using VPS offers many advantages over using a computer at home. The server runs around the clock and you can use your home computer without affecting your trading. Due to these advantages we always recommend the use of VPS.