Our opinion about the Expert Advisor

The seller does not use any selling strategies to market Magic FX. We consider this fact as positive, because it implies that the seller has great confidence in his Expert Advisor.

A few words about the existing reviews

Almost all of the 35 reviews (as of 02/13/2021) have 5 stars, except for two reviews with only one star. Of the latter, one review definitely contains false statements and is to be classified as fake. The other negative rating cannot be clearly classified due to a lack of information. Many of the reviewers have high ratings, which indicates experienced traders.

Backtest

What we particularly like is that no overfitting is apparent.

Statistics and also the equity history of the portfolio show that especially the year 2020 was successful and profitable. This could indicate that the developer has adapted the algorithm to the year 2020 in particular. From this, special caution is required. It would be fatal to align the money management depending on the statistics of the past 12 months, for example. Because these past 12 months had a particularly low Drawdown and represent the statisticians of recent years absolutely inadequate.

Furthermore, the Expert Advisor Magic FX seems to be quite stable regarding the recommended set files in all years tested by us. Except for the set file concerning the GBPUSD currency pair. In 2007 and 2008, the Expert Advisor suffers such huge losses, which could not be recovered even in the following 12 years.

Our final assessment

Our backtests and analysis show that Magic FX is profitable. However, it is negative that the Sortino Ratio in particular is low, ranging between 0.23 and 0.6 depending on the set file. In general, we prefer Expert Advisors with a Sortino Ratio above 0.5 for single strategies. The more often and deeper equity dips you have, the lower the Sortino Ratio will be. Simply speaking, this means that with a lower Sortino Ratio you earn a lower profit with the same risk.

Live signals

There are several live signals available, both real and demo.

Live signal: https://www.mql5.com/en/signals/833668

Live signal: https://www.mql5.com/en/signals/907936

Demo signal: https://www.mql5.com/en/signals/824287

Raw backtest results

For the backtests we used the set files provided by the vendor with the lot size = 0.01.

The backtest results are best viewed on high-resolution screens.

Click on one of the tabs below to open the corresponding backtest.

-

EURAUD_GMT+3 M5 (1)

-

EURAUD_GMT+3 M5 (2)

-

EURCAD_GMT+3 M5

-

GBPCAD_GMT+3 M5

-

GBPUSD_GMT+3 M5

Statistical analysis

| Setfile | Sortino Ratio | Downside Deviation | Independence Factor |

|---|---|---|---|

| EURAUD_GMT+3 M5 (1) | 0.6 | 3.3 | 0.7 |

| EURAUD_GMT+3 M5 (2) | 0.34 | 4.2 | 0.7 |

| EURCAD_GMT+3 M5 | 0.36 | 2.99 | 0.7 |

| GBPCAD_GMT+3 M5 | 0.23 | 4.35 | 0.7 |

| GBPUSD_GMT+3 M5 | 0.008 | 7.11 | 1 |

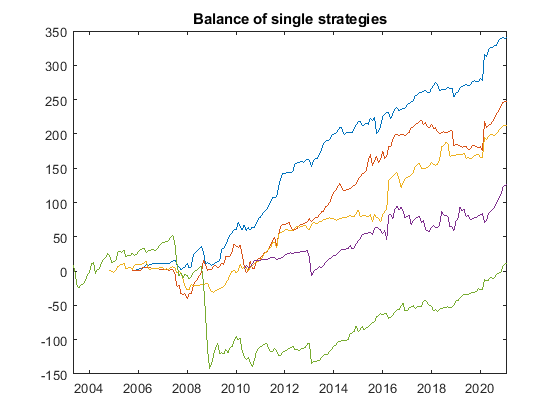

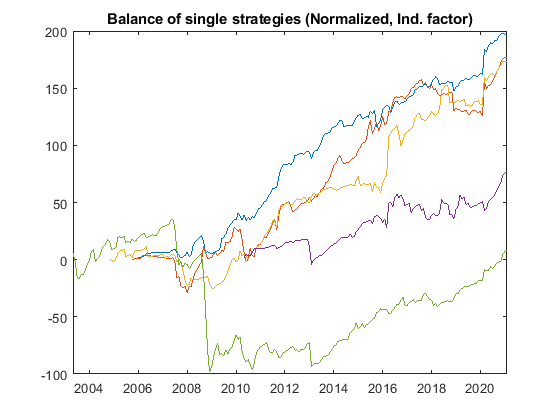

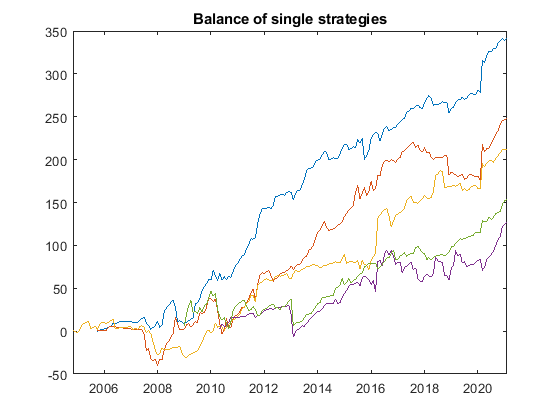

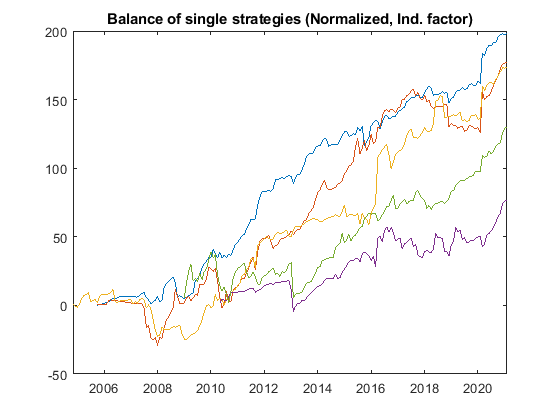

Single setfiles / strategies

The two following figures show the single setfile or strategy results with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balances in the right curve are irrelevant, what counts is that the balance sheets with higher risk and higher correlation are weighted lower.

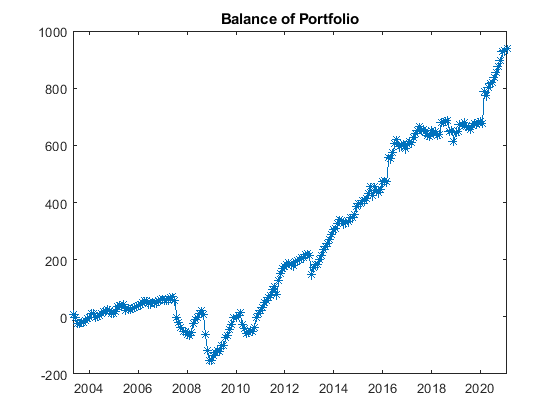

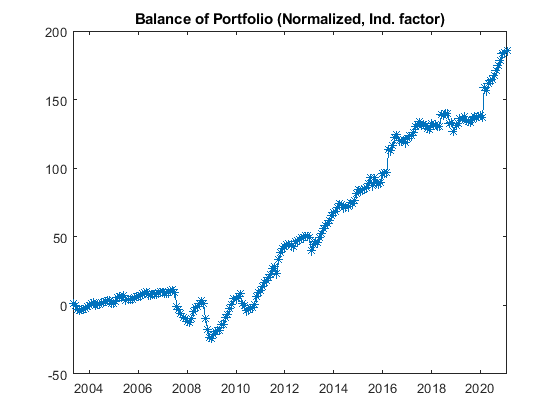

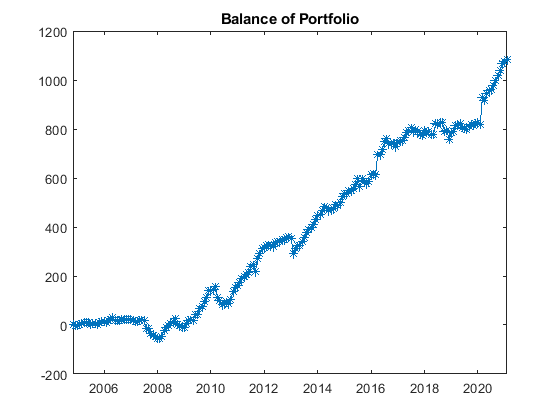

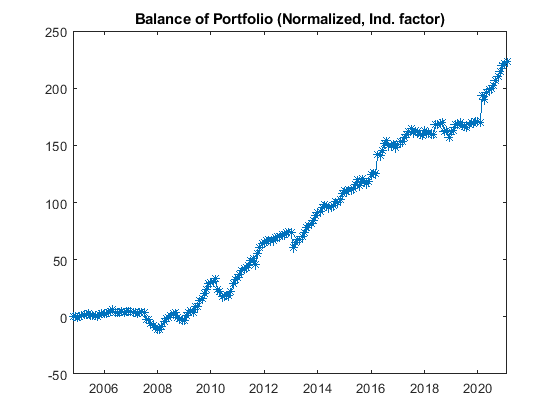

Portfolio with all setfiles / strategies

The two following figures show the portfolio balance with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balance of the right curve is irrelevant, what counts are the slightly smoother curve and the statistics.

Final statistical results of the portfolio

The factors show significant improvements by weighting each strategy. Very striking is the Sortino ratio, which increases by about 327%.

| Portfolio related factors (on monthly basis) | Unweighted | Weighted | Improvement |

|---|---|---|---|

| Sortino ratio | 0.10452 | 0.4467 | 327.38 % |

| Return/Drawdown ratio | 4.0569 | 5.1384 | 26.66 % |

| Calmar ratio | 0.018958 | 0.024011 | 26.66 % |

Weighted: Downside Deviation and Independence factor

Statistical analysis (GBPUSD from 2009)

| Setfile | Sortino Ratio | Downside Deviation | Independence Factor |

|---|---|---|---|

| EURAUD_GMT+3 M5 (1) | 0.6 | 3.3 | 0.7 |

| EURAUD_GMT+3 M5 (2) | 0.34 | 4.2 | 0.7 |

| EURCAD_GMT+3 M5 | 0.36 | 2.99 | 0.7 |

| GBPCAD_GMT+3 M5 | 0.23 | 4.35 | 0.7 |

| GBPUSD_GMT+3 M5 | 0.27 | 3.96 | 1 |

Single setfiles / strategies (GBPUSD from 2009)

The two following figures show the single setfile or strategy results with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balances in the right curve are irrelevant, what counts is that the balance sheets with higher risk and higher correlation are weighted lower.

Portfolio with all setfiles / strategies (GBPUSD from 2009)

The two following figures show the portfolio balance with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balance of the right curve is irrelevant, what counts are the slightly smoother curve and the statistics.

Final statistical results of the portfolio (GBPUSD from 2009)

The factors show significant improvements by weighting each strategy. Very striking is the Sortino ratio, which increases by about 172%.

| Portfolio related factors (on monthly basis) | Unweighted | Weighted | Improvement |

|---|---|---|---|

| Sortino ratio | 0.23185 | 0.63077 | 172.06 % |

| Return/Drawdown ratio | 11.5196 | 11.9256 | 3.52 % |

| Calmar ratio | 0.058774 | 0.060845 | 3.52 % |

Weighted: Downside Deviation and Independence factor

hey brother do you have the EA ? i can’t find it anywhere

what Sortino Ratio means?and Calmar ratio,you use different evaluation items.

Hi kitgain, you can find information about the terms in the FAQs.

https://www.forexdecrypted.com/faq