General

The R Factor EA is a night scalper. Unfortunately, the seller does not mention this important information at any point. Night scalpers try to make small profits at night, usually this strategy is very risky and can quickly get "out of control". Especially at night, due to lack of liquidity, sharp jumps in the price can occur, which can lead to large drawdown and thus wipe out all profits and deposits. Especially with night scalpers, it must be expected that there can be large differences between real results and backtest results. See also Scalping under FAQ. In order to trade successfully with night scalpers a broker with particularly low spreads is necessary, we can recommend IC Markets in particular at this point.

The seller claims that a team worked on the R Factor EA for 4 years until they released the Expert Advisor. We cannot verify this claim and have doubts to what extent it is true. Each buyer has to decide that for himself.

Furthermore, we cannot find any noticeable and strongly influencing marketing strategies.

Reviews (MQL5 Market)

We could not find any abnormalities among the reviews on MQL5 Market.

Backtests

The seller of R Factor EA can already show real results over a period of more than one year. Therefore, we decided to first adjust the backtest results to the real results in the given period. The adjustment was made using the set files from January 9, 2021, after which we created backtest with the resulting settings over the largest possible period. In addition, we created backtest for the recommended currency pairs with the set files of March 25, 2021.

For all backtests we used "lot size = 0.01" and additionally normalized the real trades to this size to be able to compare the results.

Set files from 2021.01.09

Adjustment of backtests to real results

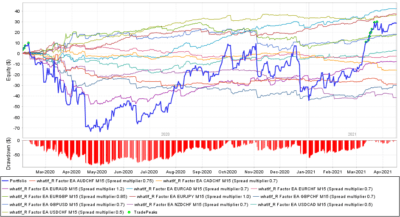

We first created backtests of the R Factor EA with the set files provided by the seller (January 9, 2021) for the period February 3, 2020 – April 15, 2021. We performed the backtests with different spread multipliers to adjust the backtest results as best as possible to the real results of the signal R Factor Mean Reversal. See for more information the article How to Backtest Expert Advisors the Right Way. The spread multipliers have proven to be sufficiently accurate as follows.

Spread multiplier adjusted to each currency pair:

- AUDCHF: 0.75

- CADCHF: 0.7

- EURAUD: 1.2

- EURCAD: 0.7

- EURCHF: 0.7

- EURGBP: 0.85

- EURJPY: 1.0

- GBPCHF: 0.7

- GBPUSD: 0.7

- NZDCHF: 0.7

- USDCAD: 0.5

- USDCHF: 0.5

It should be noted that the ratio of the spreads is variable over time and certainly changes throughout. Now the important question is not whether the ratio changes, but whether it changes relevantly to the trading results, i.e. whether the trading results change significantly or whether the errors in the results statistically even out over time. In this context, the ratio of the spread for the R Factor EA was adjusted only within a certain small period of time, but we do not know the ratio of the spread in the previous period. So, of course, the ratio of the spread may change over time relevant to the trading results. Nevertheless, this adjustment achieves the highest possible probability for realistic backtest results.

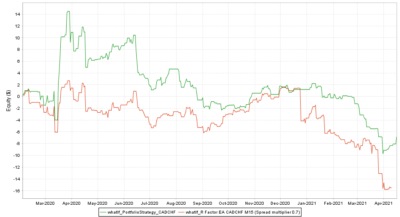

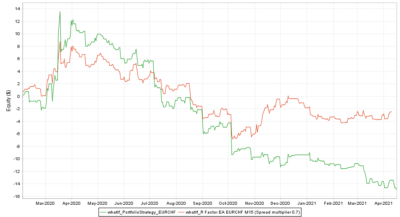

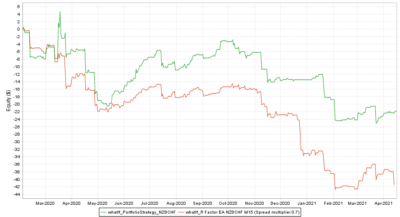

Single strategies in comparison (Backtest vs. Real)

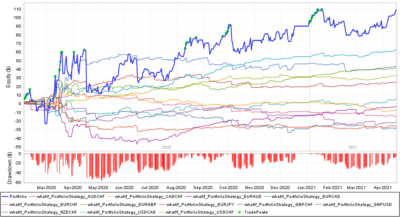

Portfolios in comparison (Backtest vs. Real)

The images below show the balance between the backtest results and the real results for comparison. A large correlation can be observed. In particular, within two time ranges the trajectories drift apart; April to May 2020 and December 2020 to January 2021. The former time range can possibly be explained by the use of other set files as this is the start of trading. The latter time range can be explained by the pausing of the R Factor EA due to Christmas and New Year. To be able to look at the trajectories without the effect of the first time range, the trajectory from May 2020 is also shown below.

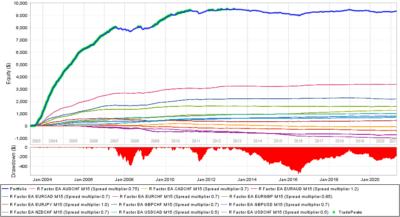

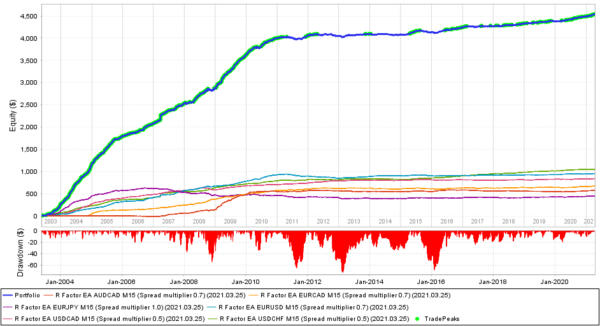

Backtests for the maximum time period and determination of profitable currency pairs

Using the appropriate spread multipliers, we created backtests for the maximum time period available. Most strategies have proven to be profitable in the short term, but not profitable in the long term. In our opinion, the following currency pairs can be considered profitable.

Profitable currency pairs: EURCAD, EURJPY, USDCAD, USDCHF

Below is the balance of the entire portfolio and the portfolio with profitable strategies for different time periods and against each other.

It should be noted that the profitability of the R Factor EA is very much dependent on the spread. Therefore, a broker with very low spreads is absolutely necessary here. Furthermore, we have not considered the individual strategies depending on long and short positions. This consideration can possibly reveal further profitable currency pairs or strategies.

There seems to be a break point between the results up to 2011 and after. We can only speculate what the causes might be. One possible cause would be, for example, the adjustment of the Expert Advisor's trading parameters on the part of the developer from 2011 onwards. It would also be conceivable, however, that there was a deterministic or stochastic change in certain signal parameters of the broker, to which the R Factor EA reacts particularly strongly.

Set files from 2021.03.25

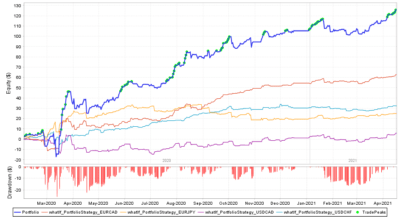

We have performed the backtests with the currency pairs recommended by the vendor of the R Factor EA.

The currency pairs recommended by the vendor are: AUDCAD, EURAUD, EURCAD, EURJPY, EURGBP, EURUSD, EURSGD, GBPUSD, GBPCAD, GBPAUD, USDCHF, USDJPY, USDCAD.

Using the spread multipliers derived from previous results, we created backtests for the maximum time period available. Most of the strategies turned out to be not profitable. In our opinion, the following currency pairs can be considered profitable.

Profitable currency pairs: AUDCAD (new), EURCAD, EURJPY, EURUSD (new), USDCAD, USDCHF

Below is the portfolio of these currency pairs (lot size = 0.01).

Statistical analysis

Due to the breakpoint already described above, we will apply the analysis exclusively to the backtest results from 2011. Additionally, we will only include the currency pairs that we believe are profitable.

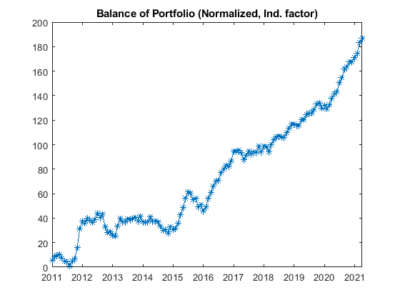

Single strategies (balance and statistical results)

The two following figures show the single strategy balances with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balance results of the left and right figure are irrelevant, what counts is that the balance of the strategies with higher risk and higher correlation is weighted lower.

| Setfile | Sortino Ratio | Downside Deviation | Independence Factor |

|---|---|---|---|

| R Factor EA AUDCAD M15 (Spread multiplier 0.7) (2021.03.25) | 0.091 | 2.403 | 1 |

| R Factor EA EURCAD M15 (Spread multiplier 0.7) (2021.03.25) | 0.393 | 2.135 | 0.742 |

| R Factor EA EURJPY M15 (Spread multiplier 1.0) (2021.03.25) | -0.053 | 3.576 | 1 |

| R Factor EA EURUSD M15 (Spread multiplier 0.7) (2021.03.25) | 0.028 | 3.085 | 0.756 |

| R Factor EA USDCAD M15 (Spread multiplier 0.5) (2021.03.25) | 0.513 | 1.768 | 0.742 |

| R Factor EA USDCHF M15 (Spread multiplier 0.5) (2021.03.25) | 1.026 | 1.74 | 0.756 |

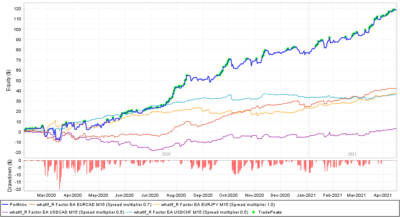

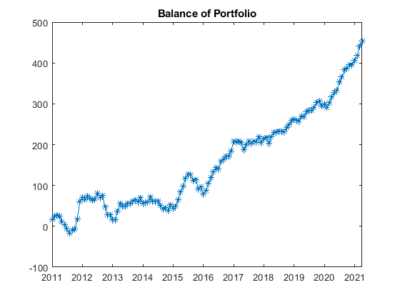

Portfolio (balance and statistical results)

The two following figures show the portfolio balances with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balance result of the left and right figure is irrelevant, what counts are the slightly smoother balance curve and the statistics.

| Portfolio related factors (on monthly basis) | Unweighted | Weighted | Improvement |

|---|---|---|---|

| Sortino ratio | 0.59232 | 0.75633 | 27.69 % |

| Return/Drawdown ratio | 5.426 | 8.2016 | 51.15 % |

| Calmar ratio | 0.043758 | 0.066142 | 51.15 % |

Weighted: Downside Deviation and Independence factor

Final assessment

First of all, we are surprised that the seller does not point out that R Factor EA is a Night Scalper. This should actually be self-evident. This is because the Expert Advisor is very dependent on the spread and thus on the broker. A broker with very low spreads is absolutely necessary, such as IC Markets. Our backtest results indicate that only a few currency pairs are profitable in the long run. Nevertheless, R Factor EA is profitable overall, this is shown by both real results and backtest results in terms of long term. Furthermore, no evidence was found that overfitting occurred. We were able to determine that the seller is constantly developing the EA so that improvements and adjustments can be made and any bugs can be fixed. Furthermore, the seller sells only one Expert Advisor, so he can fully focus on it. In addition, we did not notice any aggressive marketing strategies. Although only a few currency pairs seem to be profitable in the long run, we feel that the current price of 519 USD is justified.

Addition

Live signals

- R Factor Mean Reversal (Myfxbook)

- RFactor Portfolio JM

- R Factor Exotic

- RFactor GBPUSD JM

- RFactor EURCAD JM (Offline since July 27, 2021)

- RFactor USDCHF JM (Offline since July 27, 2021)

- R Factor USDCHF High Risk

- RFactor on EURCAD High Risk

- R Factor GBP Pairs Aggressive

Raw backtest results

We have tested with the lot size = 0.01.

The backtest results are best viewed on high-resolution screens.

Set files from 2021.01.09

Set files: R_Factor_Portfolio_Sets_M15_2021.01.09.zip

Click on one of the tabs below to open the corresponding backtest.

-

R Factor EA AUDCHF M15 (Spread multiplier 0.75)

-

R Factor EA CADCHF M15 (Spread multiplier 0.7)

-

R Factor EA EURAUD M15 (Spread multiplier 1.2)

-

R Factor EA EURCAD M15 (Spread multiplier 0.7)

-

R Factor EA EURCHF M15 (Spread multiplier 0.7)

-

R Factor EA EURGBP M15 (Spread multiplier 0.85)

-

R Factor EA EURJPY M15 (Spread multiplier 1.0)

-

R Factor EA GBPCHF M15 (Spread multiplier 0.7)

-

R Factor EA GBPUSD M15 (Spread multiplier 0.7)

-

R Factor EA NZDCHF M15 (Spread multiplier 0.7)

-

R Factor EA USDCAD M15 (Spread multiplier 0.5)

-

R Factor EA USDCHF M15 (Spread multiplier 0.5)

Set files from 2021.03.25

Click on one of the tabs below to open the corresponding backtest.

-

R Factor EA AUDCAD M15 (Spread multiplier 0.7)

-

R Factor EA EURAUD M15 (Spread multiplier 1.2)

-

R Factor EA EURCAD M15 (Spread multiplier 0.7)

-

R Factor EA EURGBP M15 (Spread multiplier 0.85)

-

R Factor EA EURJPY M15 (Spread multiplier 1.0)

-

R Factor EA EURSGD M15 (Spread multiplier 0.7)

-

R Factor EA EURUSD M15 (Spread multiplier 0.7)

-

R Factor EA GBPAUD M15 (Spread multiplier 0.7)

-

R Factor EA GBPCAD M15 (Spread multiplier 0.7)

-

R Factor EA GBPUSD M15 (Spread multiplier 0.7)

-

R Factor EA USDCAD M15 (Spread multiplier 0.5)

-

R Factor EA USDCHF M15 (Spread multiplier 0.5)

-

R Factor EA USDJPY M15 (Spread multiplier 0.7)